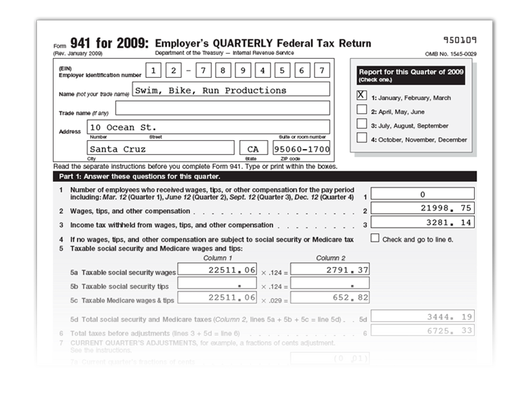

Automated Tax Compliance

SwiftChecks handles your payroll tax requirements. We calculate and pay your taxes electronically and prepare and e-file your state and federal tax forms for you.

|

TAX CALCULATIONS AND PAYMENTS

All federal, state, and local taxes are calculated automatically and your tax payments are made electronically on your behalf. TAX FORM FILINGS

Your required tax forms are prepared for you and electronically filed with the appropriate government agencies. We store your forms online so you can get them at any time. W-2 AND 1099 FILINGS

We prepare and electronically file your W-2 and 1099 forms for you. You can retrieve copies from within the online system whenever you need them. |

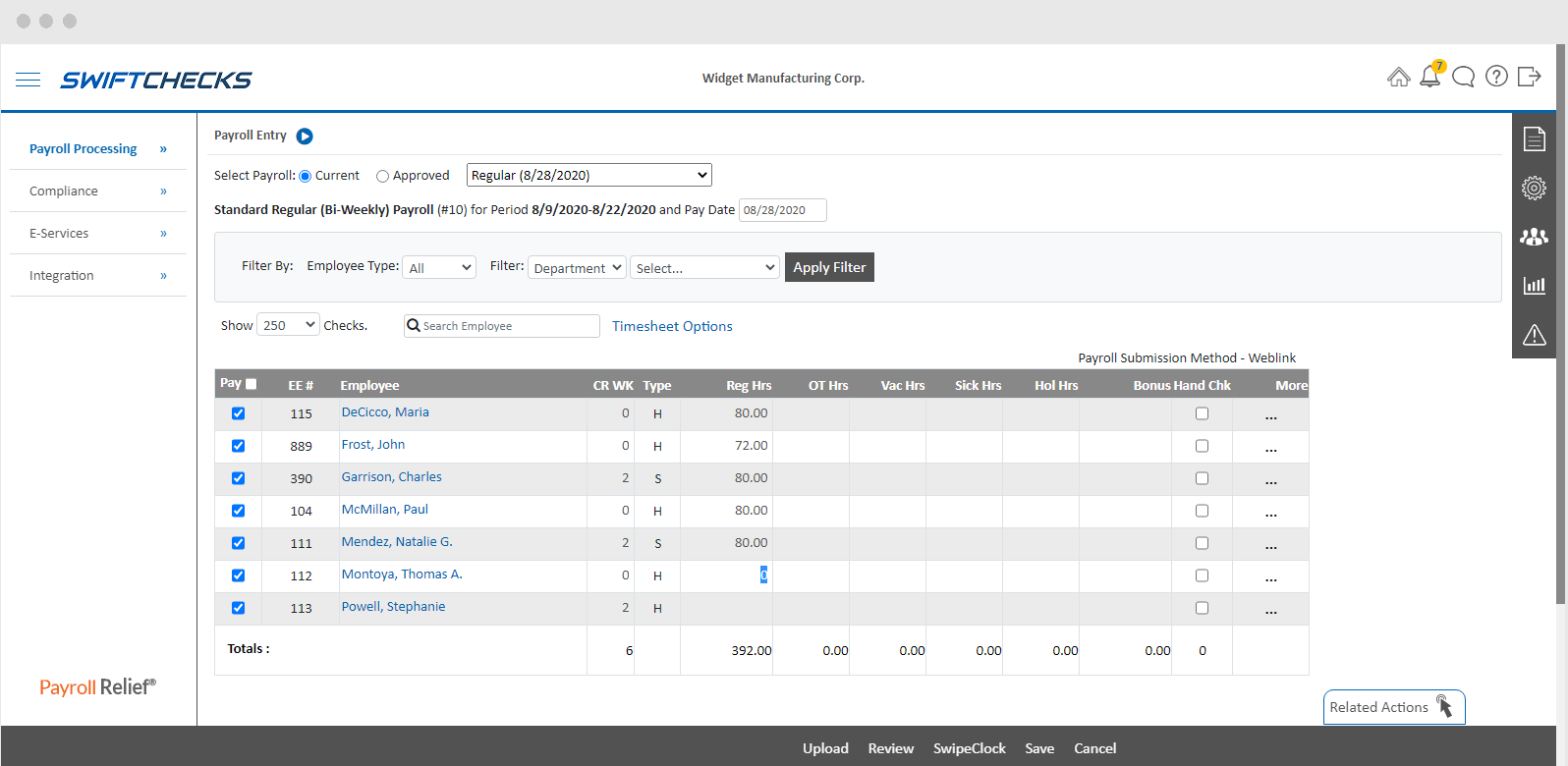

Processing Your Payroll

SwiftChecks will set up and customize your payroll account for you and include any pay category or deduction types your payroll requires. Once we have your account configured to your specifications you can enter hours from the easy to use payroll entry screen, import hours from a .csv file or your timekeeping system, submit by email, or set your payroll to run on AutoPay.

|

PROCESS ONLINE Securely submit payroll online and receive amazing support from our team whenever needed. |

SUBMIT BY EMAIL Submit a timesheet from your email each pay period and we will take care of the rest. |

SET TO AUTOPAY If your payroll stays the same each pay period we can set it to run automatically for you. |

100% Accuracy Guarantee

SwiftChecks partners with a national payment processing firm so that we can provide our clients with guaranteed accurate tax and compliance services in all 50 states. This partnership allows us to combine the protection and peace of mind of a larger payroll service, with the outstanding support and personalized attention that only our expert team can provide. Our payment processor transfers money and electronically files forms for over twenty-five thousand businesses throughout the United States.

Flexible Payroll Features

Our payroll system is loaded with convenient features so we can meet the needs of nearly any payroll client.

|

|